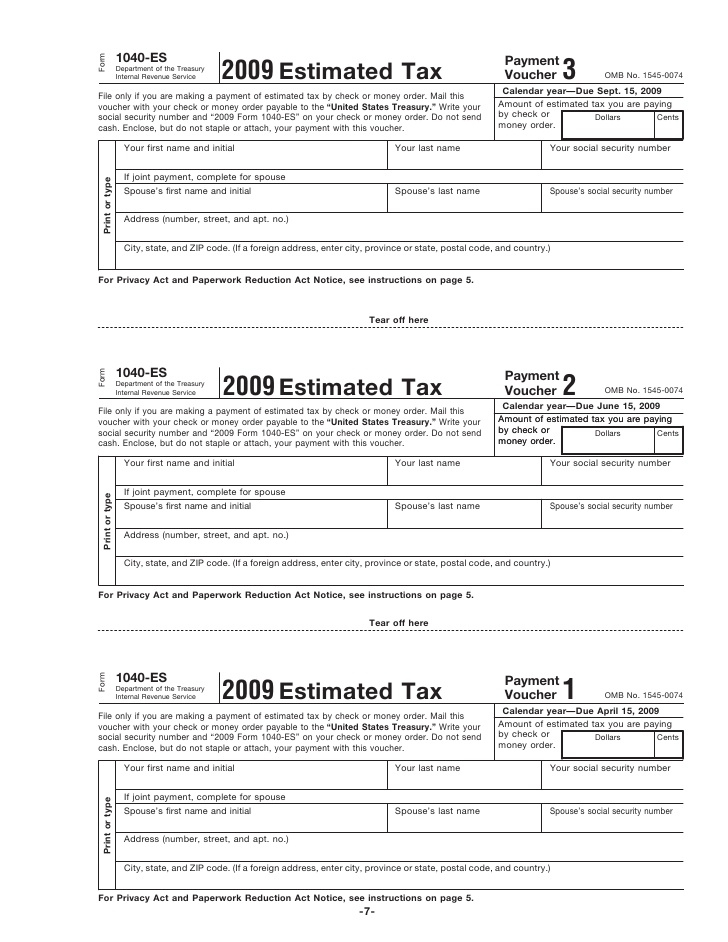

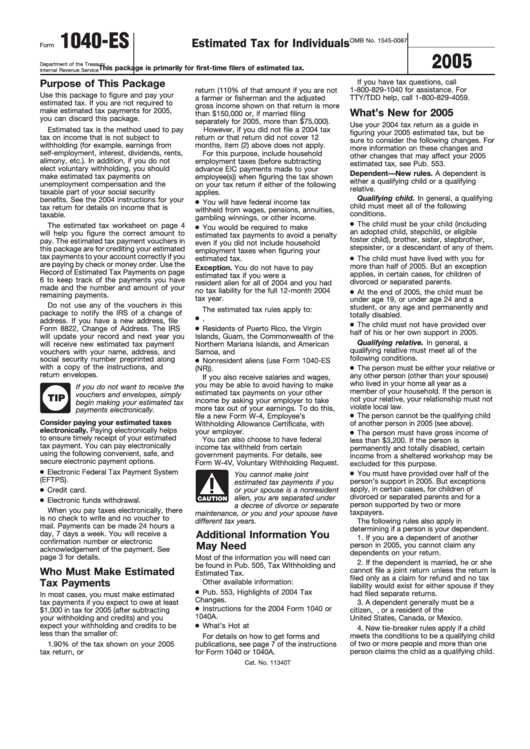

Enter the sum on Line 202 of your Estimated Tax Worksheet. Provide your expected wages (if subject to social security tax or the 6.2% portion of tier 1 railroad retirement tax).Īdd Lines 4 and 9. This line shows the social security tax maximum income. Provide you expected Conservation Reserve Program payments if you will have farm income and receive social security retirement or disability benefits.

Provide all your expected earnings subject to self-employment tax. Self-Employment Tax and Deduction Worksheet for Lines 1 and 9 of the Estimated Worksheet Follow the instructions below to fill out the form accurately. How to fill out Form 1040-ES?įorm 1040-ES contains several parts. When the due date falls on a legal holiday or weekend, the next business day becomes the new due date.

Virgin Islands, Guam, the Commonwealth of the Northern Mariana Islands, and American Samoa, and non-resident aliens. citizens, resident aliens, residents of Puerto Rico, the U.S. They may be independent contractors and freelancers who do not have an employer and whose income is not subject to withholding.Įstimated taxes apply to U.S.

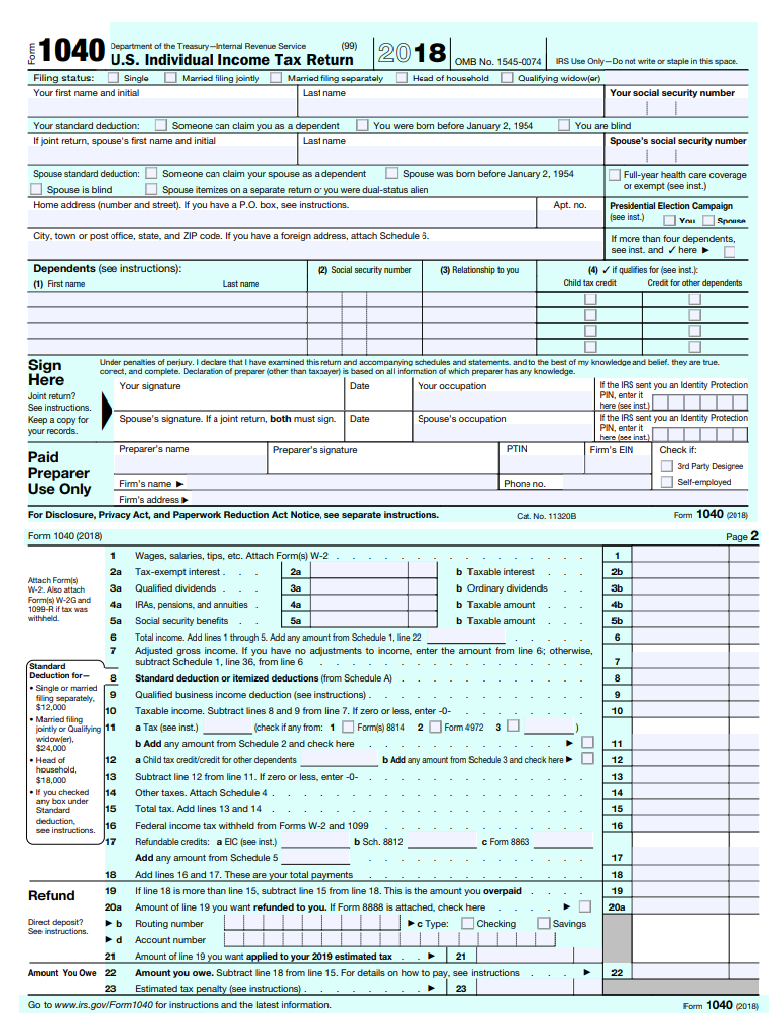

Individuals who need to pay estimated taxes are self-employed professionals. Unlike Form 1040, Individual Income Tax Return, which taxpayers use to file their income tax return from the previous tax year, Form 1040-ES calculates the first to third-quarter taxes of the current year and fourth-quarter taxes of the previous year separately, depending on which is due. In addition, if you do not elect voluntary withholding, you should make estimated tax payments on other taxable income, such as unemployment compensation and the taxable part of your social security benefits.” For example, earnings from self-employment, interest, dividends, rents, alimony, etc. Form 1040-ES, Estimated Tax for Individuals, is a tax form by the Internal Revenue Service (IRS) taxpayers use to calculate and pay estimated quarterly taxes.Īccording to the IRS, “estimated tax is the method used to pay tax on income that is not subject to withholding.

0 kommentar(er)

0 kommentar(er)